We Help MORTGAGE LENDERS Improve PRODUCTIVITY and PROFITABILITY

Transform Your Business

Strategic Guidance

Build a sustainable business model that is profitable regardless of business conditions. Our Guidance is Action-Oriented, Data Driven and Fact-Based. [MORE…]

Profit Driven Focus

We focus on how your people, process and products deliver Top-Tier performance. We provide Transparency, Visibility and Initiators for Action (“TVI”). These are the essential metrics that matter. All else is noise. [MORE…]

Optimize Your Business Process

Achieve “Low-Cost Producer” status. Eliminate non-productive costs. [MORE…]

Tech Stack Optimization

We optimize the Tech Stack you already have to get the most out of your Tech investment. Our approach quickly adjusts the configuration of your existing Tech investment without adding or changing out Tech Stack elements. [MORE…]

Email [email protected]

Strategic Guidance

Which channels, branches, people, products and processes contribute to profit? Which ones don’t? Scale your organization to ensure costs fit within available revenue. Consider acquisition, merger, divestment of business segments. We’ve help 300 financial services businesses prosper in both difficult and robust business conditions. Contact us for a confidential discussion. [calendly and/or email reach out]

Profit Driven Focus

Our research indicates that 30-40% of your people provide 70-80% of your profitability. The same is true for products and process. Over time, productivity suffers because the market and business changes, but your organization does not change to keep up.

We ensure your people, process and products all contribute to profitability. Transparency, visibility and initiators of required action (TVI) metrics ensure profit contribution and indicate granular actions to improve profitability. Our TVI metrics quickly identify your most top tier performers. Those in the middle. And those who provide the least productivity, sales and contribution to profit.

Our structured process helps you recognize and recruit more TopTier performers. Coach and level up those in the middle to up their game to the top tier. We help set minimum performance standards for the bottom tier to manage them up to minimum performance standards, or out of the organization.

The result is a substantial improvement in profitability, transparency and visibility. Our TVI metrics are computed daily and encourage every member of your team to continuously improve. That’s how you become a TopTier company

Optimize Your Business Process

Achieve low-cost producer status. Eliminate non-productive elements of you existing process. We use a structured approach to quickly and effectively evaluate your business process. We review each granular activity of your current process and determine:

- Eliminate: Can this activity be eliminated as it may no longer be needed, or is duplicated elsewhere? If not;

- Automate: Can this activity be automated using your existing tech stack, robotics or other automation tool? If not;

- Outsourced: Can this activity be outsourced to a specialty provider either on or off-shore? If not;

- Optimize the activity to be the most productive and efficient it can be.

This is our EAOO process. We use automated tools where applicable to assist in this assessment. The end result is a recommended business process, a detailed book of work to transform your business and process and an evaluation of the cost and efficiency improvements to be gained. If desired, we can implement the book of work, assist your team to perform the book of work or you can implement with your own team.

Tech Stack Optimization

Get what you are paying for from your tech stack. Your tech stack was assembled over time, with many “solutions” tacked on to solve a particular issue. But its been a long time since you looked at your tech stack from top to bottom. Our experience suggests that the tech stack has conflicting configurations, obsolete elements and contributes to “human spackle”. Human spackle are personnel added to fill the cracks in business process. Spackle initially overcomes the many issues that creep into business process over time. It’s easier to add people quickly to manually fill in for poor tech stack performance. Over time, you end up with too many people, poor tech stack performance and a very expensive business process. We evaluate your tech stack, help you optimize it and eliminate human spackle to save substantial costs and improve efficiency.

Are you ready to make a change?

There is a need for innovation when facing challenges.

Industry Insights

Innovation and Simplification of Your Business Process

What’s an executive in a fighter aircraft have to do with mortgage lending?

The flight was a learning laboratory on how automation in a new technology platform can speed learning and adoption of new skills. It’s relevant in aviation and in mortgage banking.

Fly with Teraverde’s President Maylin Casanueva as she advanced from a zero-time pilot to mastering new skills, aided by technology in the aircraft. And how her learnings can help your team achieve productivity increases with your existing technology platform. She flew with a real U.S. Air Force Top Gun instructor pilot. And yes, she pulls 4Gs in an inverted Top Gun Maverick maneuver!

Read the Article

Is your mortgage technology living up to your expectations?

HousingWire recently interviewed Rob Peterson from Teraverde. He has seen good times and bad times in his 15+ years in the industry.

As CTO and Chief Innovation Officer at Teraverde, Rob is focused on helping clients implement technology.

Learn more >>

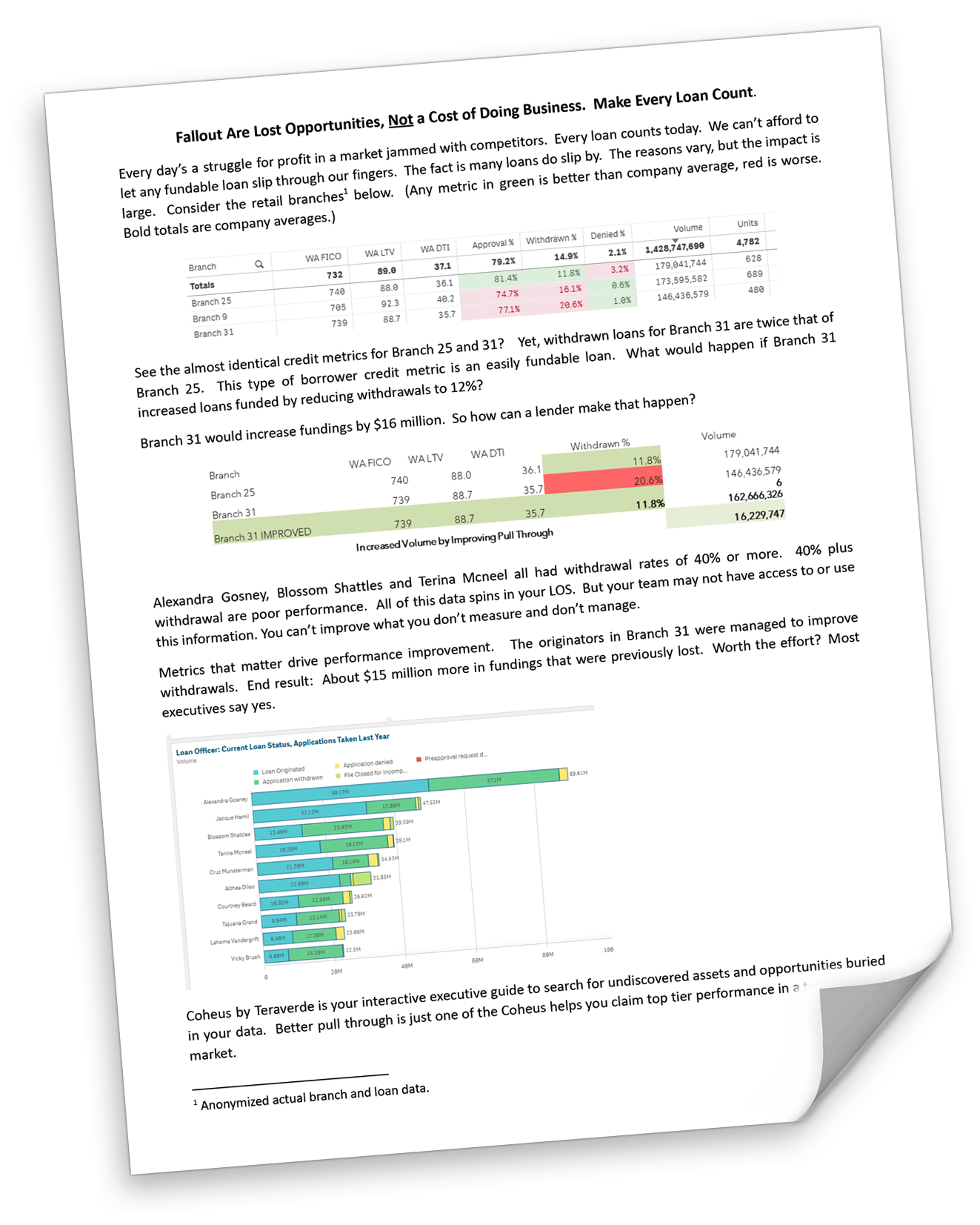

Fallout Are Lost Opportunities. Not a Cost of Doing Business

What would happen to your BOTTOM LINE if you could reduce

FALLOUT?

See how your data will help reduce fallout and increase profits.

Learn more >>

Become a TopTier(TM) Profit Driven Leader

About 30% of employees produce about 80% of your company’s profits.

Our work with clients and their Encompass Data has demonstrated that over and over.

The question you have to ask yourself is, “If that is true, how do I fix it?

Learn more >>