Blogs

What Is the Fuss Over URLA?

URLA stands for Uniform Residential Loan Application and is the application that is used when a person is applying for a federal loan. After 20 years, it is finally getting a facelift, and mandatory adoption is March 1, 2021. How Does It Affect You as An Encompass...

What Does the Mortgage Banking Future Really Look Like?

A discussion summary with Dave Stevens, CMB and Jim Deitch, CMB, CPA Jim: The so-called “new normal” runs much deeper than masking up in public and swapping a tailored suit for sweatpants and a tee. The COVID-19 pandemic brought about an unprecedented shift in...

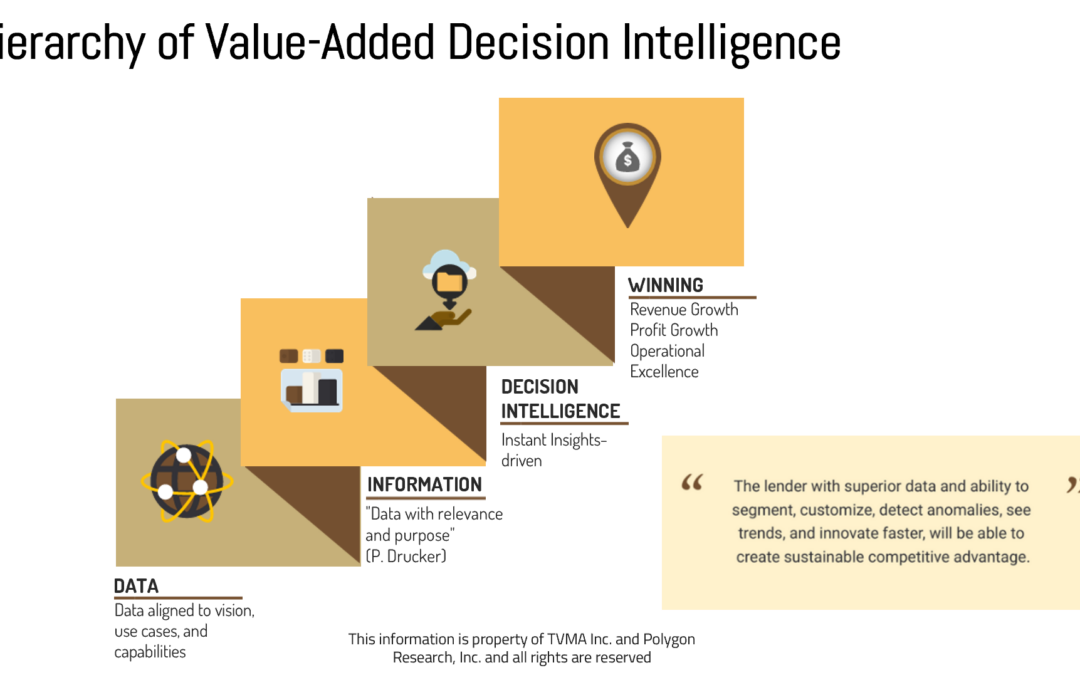

3 Reasons Executives are Prioritizing Decision Intelligence

In our previous article, The Value of Data and Decision Intelligence in 2021 — and Onward, we took a deep dive into why data management is so integral to the mortgage industry in 2021 and beyond, how lenders can use their data to assess the efficiency...

The Value of Data and Decision Intelligence in 2021 — and Onward

2020 has, without question, unveiled unprecedented challenges for businesses as well as untapped opportunities for technology. With the rate of change the mortgage industry is facing, having a digital system that tracks activity and a digital platform that processes...

Battling COVID-19 & Economic Uncertainty… Lessons Learned

This crisis is following a similar trajectory of other crises, except this is two crises together --- a public health crisis and an economic crisis. The genesis of every crisis is a lack of confidence. When loved ones’ health and economic durability are both...

Teraverde’s Profit Intelligence Solutions and Mortgage Banking Advisory Services Gain Significant Traction in Marketplace

As Demand Increases Teraverde Promotes Mauricio Valverde to Client Success Manager Lancaster, PA. – January 14, 2020 – Teraverde®, the leading provider of profit intelligence and mortgage banking advisory services which transform financial services profitability,...

Today’s Data Intelligence in Mortgage Lending

My kids and I were driving back from a school event, and Bella, my daughter asked me why I was excited about my job. Bella is seventeen years old and Jorge is sixteen, and the only world they have ever known has the iPhone, with all the services, information and...

The Ride-Hailing Disruption

The ride-hailing industry demonstrates the speed and impact of disruption. Disruption occurs quite quickly, and the transformation affects all industry participants (including lenders!). Let’s take a dive into the ride-hailing industry and see how one...

Disruption in Mortgage Lending

The Mortgage Lending Industry, like many others, realizes the need to embrace technology to do more with data. Industry organizations are trying new technology solutions to improve transparency and leverage data intelligence across multiple data sources. One...

Coheus Brings Profitability to Lending

In today’s mortgage market, lenders are struggling with constantly changing rates, rising LO compensation, low productivity, and margin compression. With paper-thin margins Mortgage Bankers are looking for solutions that will help turn the profitability tide. One of...